The cost of living and dying

The cost of living and dying has been rising since late 2021. Food and energy prices have soared, particularly gas, largely an unfortunate side-effect of the war in Ukraine. Recovery from the Covid-19 pandemic has exacerbated the crisis. But just as costs for the living have gone up, so have those for the dying and deceased’s families, with funerals becoming pricier.

The UK cost of living crisis

UK inflation has increased significantly, rising by 10.1% in the year to January 2023. In response, the Bank of England has raised its base interest rate numerous times since December 2021, from 0.1% to 4.5% as of May 2023. Figures from the Office for National Statistics (ONS) also showed average weekly earnings fell in real terms in the year to December 2022 by 3.1%. This crisis has affected almost every area of life, including: food, energy, petrol and housing.

Renting

Data from the ONS showed that private rental prices in the UK increased by 4.4% in the year to January 2023; the largest increase since the ONS’ data series began. The median monthly rent in England was £800 a month in the year to September 2022, the highest ever recorded. In London, median monthly rent was £1,475.

Home owners

According to UK Parliament:

“The Bank of England has estimated that “around four million households will be exposed to [mortgage] rate rises over 2023”. The figure includes those on variable rate mortgages and those coming to the end of fixed-rate products. The bank estimated that the number of households with high mortgage debt burdens would increase in 2023 to “2.4%, or around 670,000 households,” approaching levels comparable to the start of the global financial crisis in 2008.”

Energy

Much headline space over the past year has been dedicated to rising energy prices, a problem shared globally as wholesale gas prices quadrupled due to the war in Ukraine. The estimated average standard electricity bill, according to UK Parliament, increased by 51% or £390 to £1,160 in 2022 and the average estimated gas bill doubled, increasing by £570 to £1,134 in 2022.

Fuel

Petrol prices rose from 127.02p per litre in February 2020, to 191.43p per litre in July 2022, according to the RAC Foundation. They stand at 143.33p per litre as of 31 May 2023. For many, the added costs of fuel have exacerbated the cost of living crisis, affecting commuting and other essential travel.

Food

According to the ONS:

“The prices of food and non-alcoholic drinks rose at the second highest rate in 45 years in the year to April 2023. The annual inflation rate for food and non-alcoholic drinks was 19.2% in March 2023. Prices for alcoholic beverages and tobacco rose by 9.1% in the year to April 2023, up from 5.3% in March.

Some shoppers are taking actions to reduce their outgoings, with around 4 in 10 adults (44%) saying that they are spending less on food shopping and essentials. Meanwhile, around half (48%) of adults said they were buying less when shopping for food.”

The cost of dying

But inflation has not only affected the living, it is also a crisis for the dying. The ‘cost of dying’ refers to the total cost of a funeral – including professional fees, the funeral service, and optional extras like the funeral party or wake.

One way people can save money when considering death administration is to make a free online will, which you can do with Dorothy House, here.

So how much does it cost to die?

SunLife recently published a comprehensive report on the cost of dying.

How much does a funeral cost in the UK today?

“The average cost of dying has risen by 3.8%, from £8,864 in 2021, to £9,200 in 2022, while the average cost of a basic funeral is £3,953. At £5,283, London is the most expensive place to die, while at £3,317, Northern Ireland is the most affordable place to die.”

Is burial, cremation or direct cremation cheapest?

“At £4,794 a burial is the most expensive option. A cremation costs £3,673 on average, while a direct cremation is cheapest at £1,511. A direct cremation is the most affordable choice for a funeral, because it’s a cremation without a service.”

So what costs have increased?

Professional fees

“At £2,578 professional fees have gone up 10.9% since 2021, and they now make up 28% of the total cost of dying.”

Send-off costs

“A send-off is the added optional extras that can make a funeral more personal to the deceased and their loved ones, like the catering, memorial, wake and flowers. Send-off costs now stand at an average £2,669.”

Who’s paying for funerals?

“69% of people made provisions specifically to pay for their funeral before they passed away – up 3% since last year. But only 59% put enough aside to cover the whole cost of the funeral.”

How are loved ones making up the funeral costs?

“In 2022, 19% of families experienced financial concerns when paying for a funeral. On average, they had to find £1,870 to cover the overall costs. Most of them found the money by delving into their savings and investments, borrowing from a friend or relative, or by using a credit card.”

How to cope with the costs

The spiraling cost of living and dying means as many as 1 in 4 working age people, and 1 in 6 pension age people with a life-limiting illness could die in poverty in our community this year. Family members could also be left having to pay for a funeral they can ill afford.

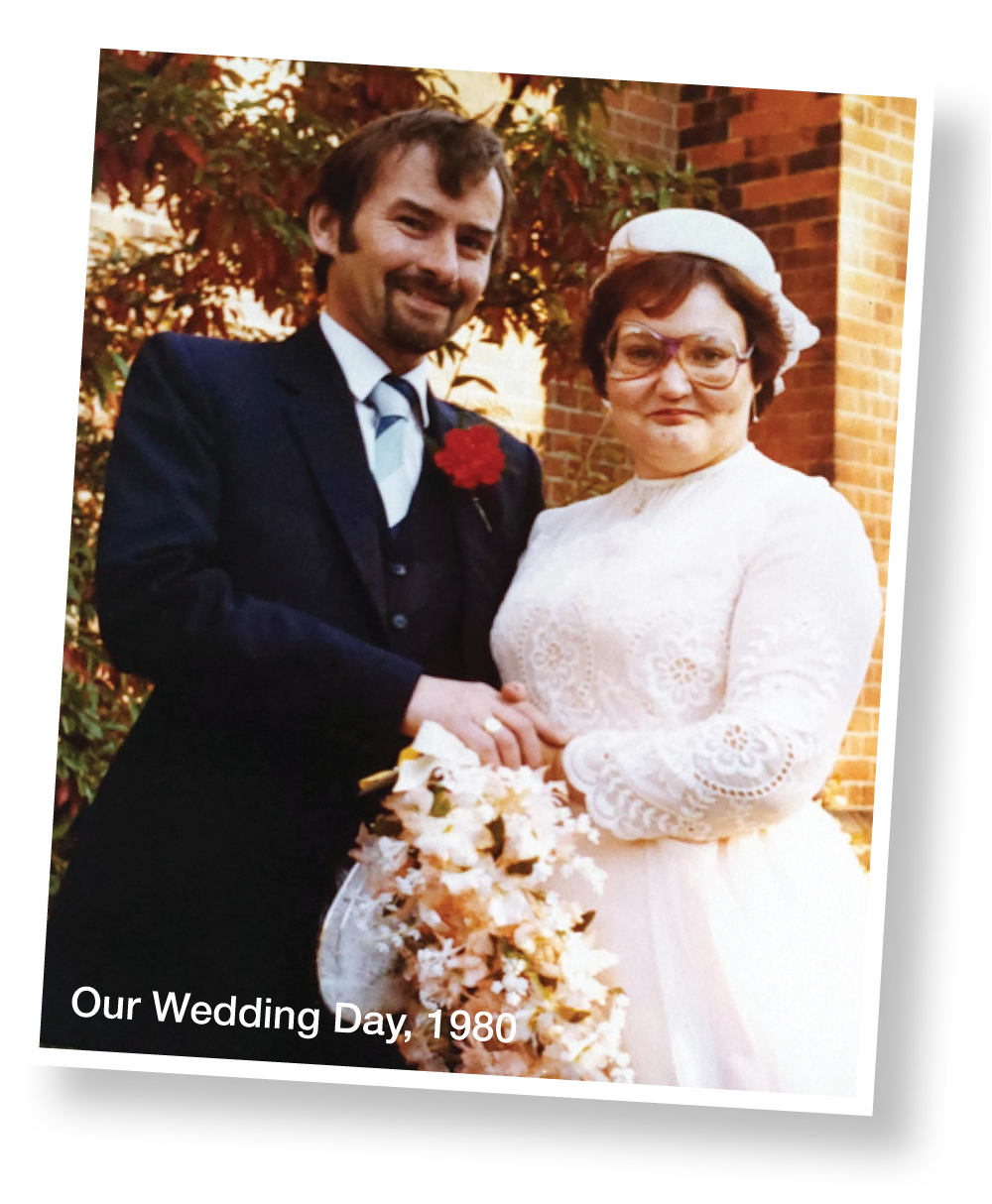

Les & Bill’s story

Les and Bill thought they were all set up for retirement.

Les and Bill thought they were all set up for retirement.

They’d worked hard all their lives, saving into pensions and paying off their mortgage. They were planning a fulfilling and comfortable retirement, selling up in London and moving out West.

Looking forward to travelling, helping their son and grandson, and generally enjoying life: “Getting to do the things we didn’t get to do while we were working so hard.”

But this all changed overnight with Bill’s diagnosis.

“All too often, a life-limiting illness can result in poverty. And that’s where Welfare Rights Advisers like me come in.

For 16 years, I’ve been applying my experience as a Welfare Rights Adviser when patients and their families need my advice and help to access financial and other support they may be entitled to.

It’s your donations to Dorothy House that help fund my role. I’m here so patients and their families can focus on treatment and care. It’s vital work. As many as 750 people are referred to me each year. And I can’t think of a single case where I haven’t been able to unlock some kind of help or support.” – Karen Gough – Welfare Rights Adviser

If you’re living with a life-limiting illness or you know someone who is and is struggling with the cost of living and dying, take a look at our Finances and Benefits page to find out how we can help.

How you can help others

At Dorothy House, we believe everyone suffering from a life-limiting illness should be able to receive the care they need. By making a donation today you can support our work across the community. Your donation will help us provide outstanding palliative and and end of life care for our patients and support for their families.

At Dorothy House, we believe everyone suffering from a life-limiting illness should be able to receive the care they need. By making a donation today you can support our work across the community. Your donation will help us provide outstanding palliative and and end of life care for our patients and support for their families.

- Share this page:

- https://www.dorothyhouse.org.uk/?p=99155